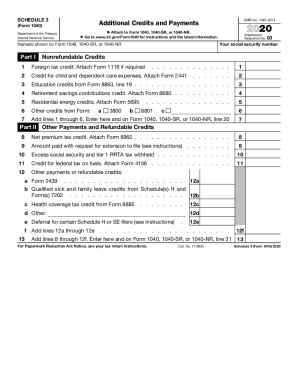

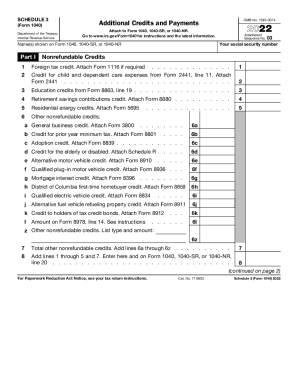

2024 1040 Schedule 3 Instructions – The Schedule 3 tax form is part of the 1040 tax return The IRS has updated the Schedule 3 tax form and instructions for the years 2023 and 2024, with a focus on making it easier for taxpayers . When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C .

2024 1040 Schedule 3 Instructions

Source : www.irs.govTax season is under way. Here are some tips to navigate it. – WAVY.com

Source : www.wavy.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.com2024 Important Tax Numbers: A Handy Guide | Financial Synergies

Source : www.finsyn.com2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comIRS Releases Schedule 3 Tax Form and Instructions for 2023 and

Source : www.kxan.comIRS 1040 Schedule 3 2020 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comOhio Taxation on X: “IT’S HERE! 🎊 The 2024 Tax Instruction

Source : twitter.comIRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com2024 1040 Schedule 3 Instructions 1040 (2023) | Internal Revenue Service: You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . You can also order paper copies of the instructions for your return at IRS.gov/OrderForms or by calling 800-829-3676. The IRS has published a list of FAQs. The entries you make on Form 1040-X .

]]>